Are you interested in finding new product/feature opportunities? Would you like to learn which product attributes are failing to meet customer expectations (underserved)? Gap analysis, or unmet needs analysis, is exploratory front-end product development research that measures deficiencies of a broad spectrum of product attributes in a category. These deficiency scores can be used to identify immediate areas for improvement in an existing product line or opportunities for development of new features for a future product line.

How it works

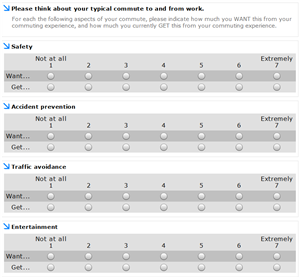

This method assumes that the respondent has first-hand knowledge of the product or product category. For each product attribute of interest, respondents are asked to directly rate their expectation of that attribute’s performance (“want”) with how the performance of that attribute (“get”). The difference between these two ratings is the deficiency score of that attribute.

For tactical research, the attributes can cover 15-25 features on the product roadmap, and results can be used to help prioritize feature prioritization. For strategic research, as many attributes as possible should be included, covering every aspect of the product, from the quality of the product and how it performs, to how the consumer personally relates to the brand. This could result in an attribute list of 100-150 items.

Pros:

Analyses of data from this type of research can be surprisingly rich. For example:

-

Our most common analysis, quadrant analysis, displays attribute importance (e.g. high average “want” scores or predictor of overall satisfaction) by attribute deficiency (e.g. average “got” scores or percent of sample deficient in that attribute). This procedure identifies attributes with immediate opportunities for improvement, secondary opportunities, table-stakes or “must-have” features, and back-burner features.

-

Deficiency scores for different brands can be compared head-to-head to find the relative strengths and weaknesses of your brand compared to a competitor. This can be used to market towards your products strengths, and highlight which attributes should be targeted for development in order to take market share from your competitor.

-

Deficiency scores can be used as bases variables for customer segmentation. This results in highly actionable target segments, because each segment is defined by which aspects of the product category are not meeting expectations.

Cons:

-

Any product attribute/feature rating task has the potential for a ceiling effect. Most product features add overall value, so it’s unlikely that a respondent would NOT want better performance from that attribute/feature. The result can be a high proportion of responses being in the high end of the “want” scale, reducing response variability and overall information.

-

When used as exploratory research evaluating 100+ attributes, respondent fatigue is a factor. The survey itself will take several sessions to complete, and respondents must be compensated appropriately.

-

There’s no guarantee that all important attributes have been included, as it’s generally impossible to include every product attribute in the survey. This can be problematic for exploratory research looking for breakout opportunities. This risk can be alleviated somewhat with qualitative customer research ahead of time to aid in survey development, adding to the time and expense of the research.